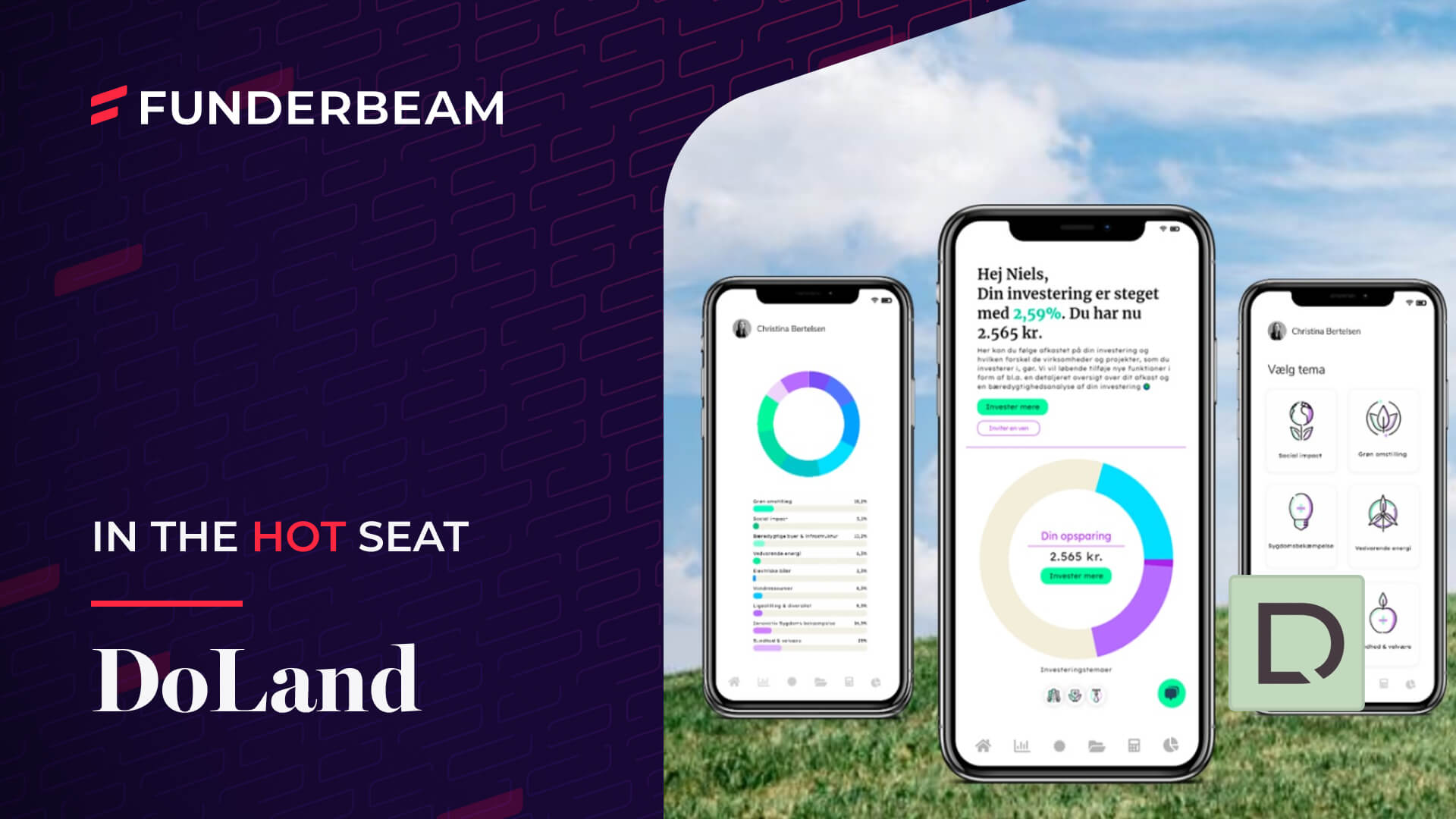

In the Hot Seat – DoLand

We put DoLand Founder & CEO Jakob Lage Hansen under the spotlight, answering questions about what DoLand is, what it aspires to be, plus the challenges and opportunities that lie ahead for the business.

Tell us in three sentences what is your company and what is the product?

DoLand is an active movement that empowers all of us to make personal real impact through new ways of investing. Our digital solution guides you to a tailored investment that reflects your preferences for sustainability and your financial situation. You can get started from 75 EUR, we make sure that the investments are executed efficiently, and you can track the positive impact and financials of your investment in MyDoLand.

Tell us how 2021 was for DoLand, what were your key challenges?

2021 was a very exciting year for DoLand. Our challenge was to fully launch the solution and prove the fundamentals of our model. We got confirmation on some key proof points: We are able to mobilize more people and assets to investments with positive impact: 40% of our customers have never invested before and close to half are women. Initial investments of our investors were EUR 1.650 and a third of customers have topped up their investment with many doing so on a regular basis.

What are your main, key goals for DoLand in 2022?

2022 will be even more exciting! We will scale the platform by entering commercial partnerships with communities, companies and organizations; and by launching new products (pension, gift-card etc.). We are also focused on strategic partnerships to leverage the solution and create new revenue streams. To this end we are establishing a subscription-based model to supplement our advisory fee revenue. Not least, we will keep raising the bar for impact investing and will evolve our investment product portfolio.

What is the outlook for the Fintech Sector in the coming year?

We are operating in the crossfield of Fintech and sustainability. Both areas are extremely dynamic, a trend we expect will continue in 2022.

Are there any key trends in the Fintech and sustainability sector you think are important to DoLand

The dynamic environment is creating opportunities for delivering new types of impact investments, something we are actively pursuing and pushing for. The increased consumer awareness and regulatory focus on sustainability are also forces we can leverage to our advantage to expand DoLand’s community.

Who are the main shareholders and management of the company and any plans for future hires or positions?

We have a great team and active owners, and are very happy to now also have our Funderbeam investors join the journey. We have recently strengthened our commercial team and are ready to accelerate our customer acquisition, community building and partnership engagement.

Can you profile or paint a picture of a typical customer of DoLand

A typical customer is a woman in her mid-30s that is interested in sustainability, but does not invest as part of a sustainable lifestyle due to lack of awareness and interest.

What is your key message to customers and how do you get that information to them?

Impact investments are key to the sustainable transition and everyone can get onboard. We make it easy for you to make a personalized difference and by being many on our platform we expand the opportunities for all of us.

What would you say are the biggest challenges ahead for DoLand

Given the strong trends it is important that we keep pushing to stay ahead by raising the bar for impact and expanding the opportunities on our platform.

And what area/geography/sector presents the biggest opportunity for DoLand

There is a large untapped potential. 6 in 10 would like to live more sustainable but only 3 in 10 use investments towards that end. That creates a huge opportunity to mobilize idle cash to investments with positive impact. The potential is both in Denmark and more widely in Europe with EUR 9 trillion on EU bank accounts.

If you could give Investors just 3 words to describe the future of DoLand, what would they be?

Movement for Impact

In Funderbeam’s tech-powered marketplace, anyone can buy and sell investments in ambitious companies, whilst founders can raise capital without borders.

Please click here to see companies currently raising funds with Funderbeam.

Looking to raise funds for your business? Let us help you.

* Capital at Risk