What is the process of Listing on Funderbeam?

The Listing Process

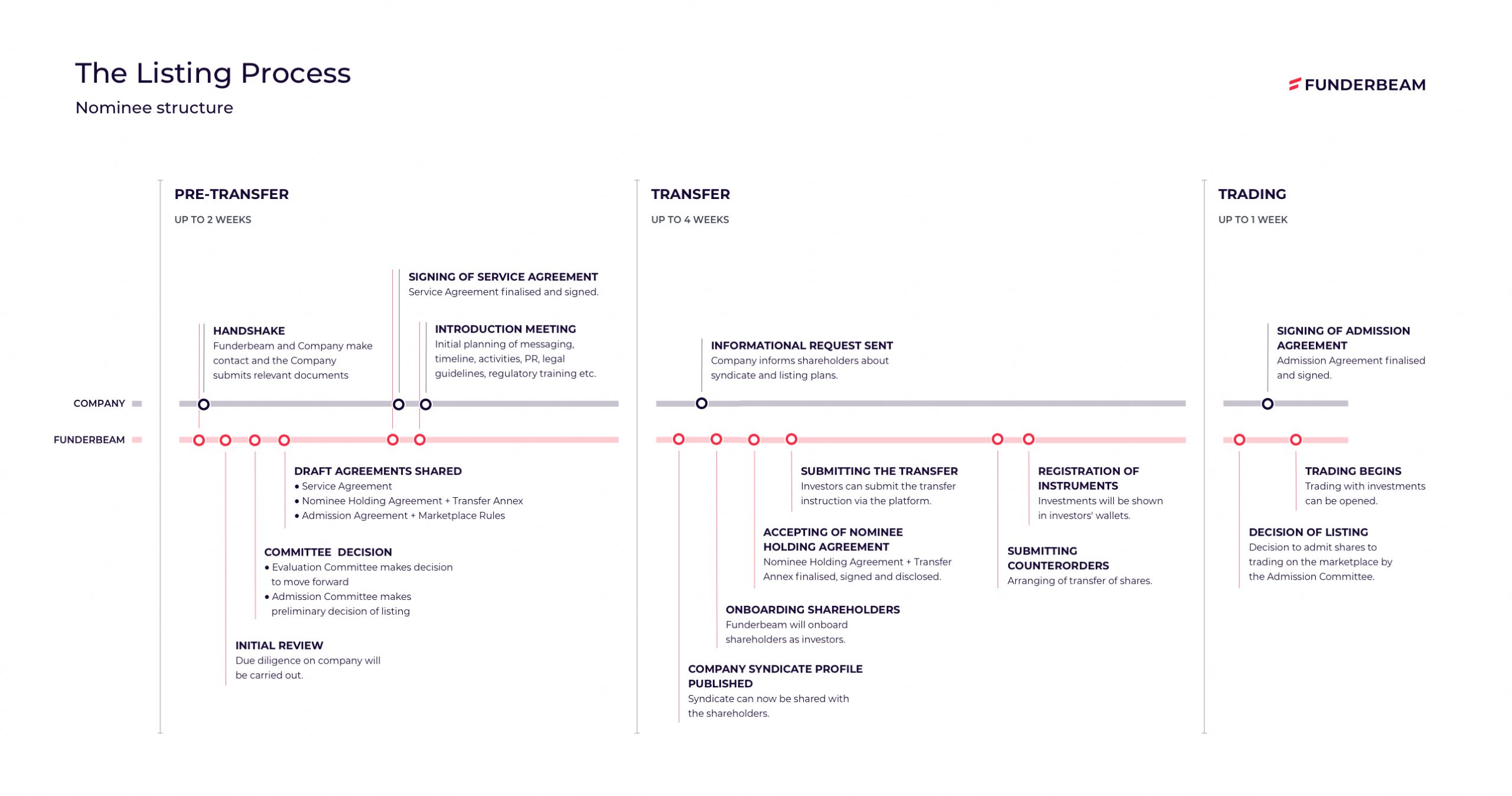

Listing on the Funderbeam marketplace is designed to be a straightforward process comprising of: basic due diligence; review by the Funderbeam Admission Committee; joining the Funderbeam platform; and the transfer of shares.

How does it work?

Companies can make their investments tradable without needing to issue new shares or raise capital (unlike an initial public offering). To do this, shareholders transfer their shares into a nominee company managed by Funderbeam, which then becomes a tradable pool of investments that can be accessed by existing or new investors. Shareholders will maintain the same rights that they have today, but Funderbeam will act as a nominee and legally hold the shares on behalf of the investor. This means that the company’s cap table will not change each time a trade is completed – the trading takes place within one holding entity.

Regulated marketplace: Shareholders are able to trade safely and securely via a regulated marketplace with published rules reviewed by the MAS.

Regulated marketplace: Shareholders are able to trade safely and securely via a regulated marketplace with published rules reviewed by the MAS.

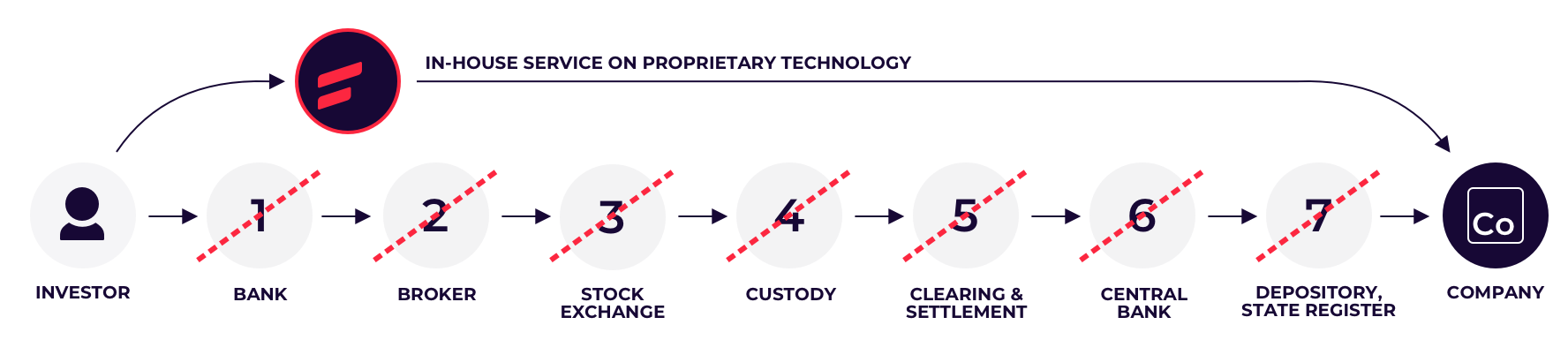

No middle-men: Funderbeam and its proprietary technology manages the full value chain.There is no need to go via a broker or intermediary in order to complete a transaction.

Click image to view in new tab.

Click image to view in new tab.

1. Due Diligence

Funderbeam carries out due diligence on the company and establishes whether it is possible to migrate shareholders onto the marketplace.

In addition to providing the relevant documentation the company will also need to establish an appropriate valuation at which to list at. This needs to be in line with previous financials and projections and will be reviewed by the evaluation and admissions committee.

2. Admissions and Service Agreement

Upon completion of the due diligence process, the company’s application is reviewed by Funderbeam’s Admissions Committee. This committee is composed of industry experts who have a wealth of experience within the financial sector alongside Funderbeam’s Head of Trading and Head of Compliance. The committee confirms that the due diligence process has been completed and the required documentation provided, and that the necessary plans are in place to complete the listing.

Once the company has been successfully approved by the Admission Committee, the company and Funderbeam will sign a Service Agreement. At this point, Funderbeam provides the company with a dedicated Account Manager to assist with the onboarding process.

3. Joining the Platform

Once the Service Agreement is signed, the company can inform its shareholders about its plans to provide them with access to liquidity via the Funderbeam platform. For this to happen, Funderbeam creates a company-specific syndicate for shareholders to join. In order to list their shares, a shareholder needs to complete the following three steps:

1. Sign up to the Funderbeam platform

The shareholder submits their details by creating an account →

2. Become a verified Funderbeam user

Shareholders are required to submit proof of identification so that Funderbeam can conduct appropriate KYC/AML checks. Learn more →

3. Join the company syndicate

Shareholders will receive a link from the company notifying them to join the company’s syndicate. They can then indicate how many shares they wish to transfer to the Funderbeam platform for trading.

At the same time, the company’s platform profile is created. This provides relevant information about the company (e.g. a description of its business, the members of its senior management team) and its share capital to all verified investors on the platform who have access to the syndicate. Typically this would be the same as the information a company would provide on its own website, or which is filed publicly with Government authorities.

4. Transfer of shares and trading

Once shareholders have asked to join the company syndicate, the company is given the opportunity for a final review of the shareholders who wish to participate, and then confirms that the transfer process may proceed. The shares are transferred to Funderbeam and displayed in each investor’s wallet – a centralised location containing their portfolio on the Funderbeam platform. Prior to trading, the company will then be asked to sign an Admission Agreement which admits the company to the Marketplace and also confirms the company’s adherence to the Marketplace Rules. Once this has been signed, shareholders are free to begin trading via the Marketplace.

You can find out more about how trading on the Marketplace works.

Requirements after Listing

General obligations

To ensure the fair, orderly, and transparent functioning of the Marketplace, companies that are admitted are responsible for:

- Disclosing regular updates on the results and operations of the company.

- Disclosing other material information which relates, directly or indirectly to the company or relevant investment, and which would reasonably be considered likely to have a material impact on the price of those investments.

Information that is made available to the Marketplace must be fair, clear and not misleading, and must be made available in a timely manner to all Investors.

Reporting Requirements

A company must regularly disclose updated information on its key performance indicators (KPIs). Funderbeam and each company will separately agree on and disclose the KPIs which are relevant and material in measuring the performance and success of the company.

Companies must provide updates:

- Monthly or quarterly reporting – this must be made available within 4 weeks of the end of the respective reporting period – this will be determined and set out in the Admissions Agreement

- Financial Statements (annual report) – this must be made available by 4 months after the end of its financial year

- Ad hoc disclosures – Companies must immediately report and publish any information that has or may have a material impact on the investment price

The Funderbeam Marketplace rules can be found via the following link: https://www.funderbeam.com/FBMSG/trading-rules