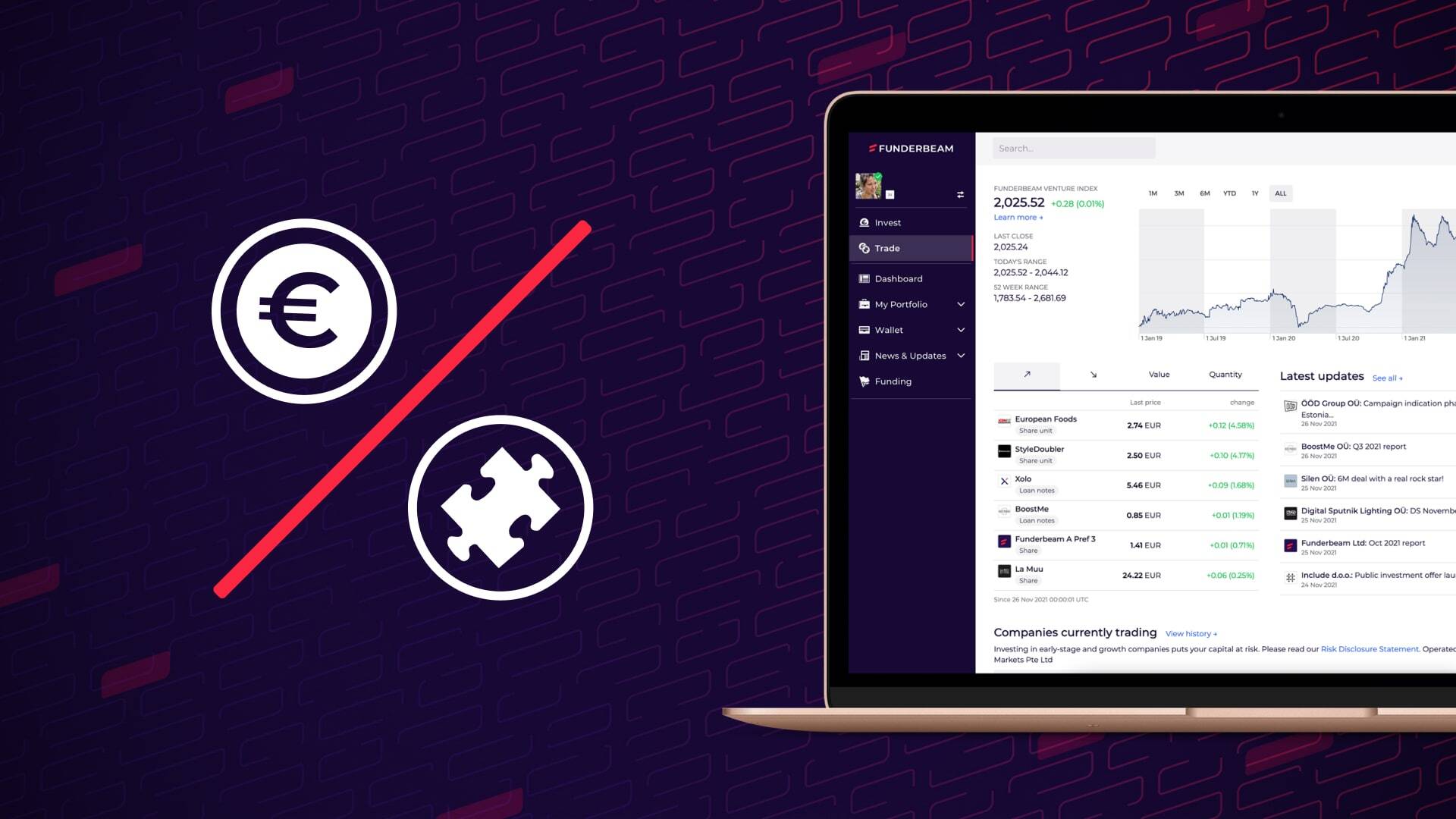

Funderbeam Exchange – a novel approach to trading

Our CEO of Funderbeam Exchange, Jacqueline Yee, explains Funderbeam’s approach to trading and how other exchange’s work

Funderbeam has received several comments about our exchange business model and elements of it like trading fees, pre-funded wallets, liquidity boosting and others. We are very proud to have such an active investor community thinking along with us and thus we’d like to discuss these topics more openly than just in our private discussion board.

Exchanges – An overview

Intermediaries

The mainstream stock exchanges operate as a trading “engine” and provide access to the market through many intermediaries.

Trading orders are passed through brokers and each investor sees the UI of the broker, not an exchange. The majority of investors see information with a 15 minute delay and no discussion is introduced. The LHV forum in Estonia hosted by the broker itself is a rare example, but it does not involve active or accurate participation of stock exchange listed companies.

Also trades are settled by many intermediaries – banks, custodial banks, central bank, CSD (Nasdaq CSD in Baltics) etc. Therefore the settlement time is T+2 (you sell today and receive money in 2 days). Due to the local intermediaries also the market participants are mainly local.

Trading fees & Funderbeam’s Competitors

When mentioning trading fees, it has not been stock exchanges who have abandoned fees, but brokers.

You might find this article “How Discount Brokerages Make Money” interesting in this context – it is written by a tech-business entrepreneur, in everyday speak, providing an overview of the broker fees landscape in order flows.

On a more serious note, “no-fee stock brokers” have gotten the attention and scrutiny from regulators such as ESMA.

Stock Exchange fees are very broadly from 4 sources – memberships (brokers), listings and quarterly fees (companies), trading (paid by brokers) and data.

If we look at the wider Funderbeam’s’ competitor landscape and dig into the truly global private companies market, we see the competition coming from Forge Global, Seedrs, Nasdaq Private Market, CartaX and others. In this group the trading fees are broadly between 1.75%-5% per transaction paid by both parties (sell side and buy side) plus additional fees paid by the company involved. See also Sifted article about Revolut secondaries.

Funderbeam’s Exchange

Funderbeam was cautious when introducing trading fees, which was introduced in January 2020.

We analysed the data of trading activity after introducing the fees and in fact the data provided no evidence of having a significant negative impact on trading activity (if at all – the recorded trading volumes in 2019 [15,412], 2020 [20,923] and YTD 24 Nov 2021 [67,014]). We have and will monitor any changes we implement and we make decisions based on the factual user data.

Funderbeam has built a marketplace where investors trade on the “engine” without any broker involved. Information is online, settlement time is instant and discussion with company involvement is introduced.

By building custody in-house, we can onboard investors and companies from several countries directly. Even though we are honoured to be compared to Nasdaq First North Baltic, we see our region much more widely and our competitors more broadly than First North. We will work on bringing more investors, including active traders, from all our markets. That is in the interest of all the parties of Funderbeam and is the best to boost the liquidity.

Comparing Funderbeam to Index Funds

It may not be particularly relevant to compare Funderbeam trading fee to fees charged by index funds.

Typically index funds are passive funds comprising a group of stocks and bonds, as a portfolio, to provide broad market exposure, and as such the performance track that benchmark group in a standardised way regardless of the state of the broader marketplace.

The lower risk and correspondingly lower returns makes it difficult for passive index funds to justify charging even very low fees in a persistently low investment return environment. The Alternative Investment Management Association (“AIMA”) reported that inflows, in the period Jan-May 2021, into the hedge fund sector reached USD57.8B.

As at Q3 2021, the global hedge fund industry manages more than USD4T, an all time high. Investors are paying fees to access active managers in alternative investments to mitigate beta risk (i.e. risk of volatility in the stock market) and achieve uncorrelated returns, with the fastest growing subset of the broad alternatives sector being private equity.

Liquidity and valuations

There is no guaranteed or definite causation-outcome relationship between higher trading activity, higher investor interest, higher valuations.

Company valuations go up when the company demonstrates they have created value or reduced their risks. Investor interest relies, in part, on the level of information asymmetry perceived present, which can be quite high in regard to private companies, so reliable and timely communication of corporate updates are key towards improving information access and awareness.

At Funderbeam, we work hard to ensure that companies admitted to trading on our platform report responsibly and that all investors gain equal access to all company information available without prejudice. We are also cautious about trading “hype’s” and about making long term decisions based on short term incentives. You may remember GameStop, which made all market participants react.

To test the early stage marketplace concept, Funderbeam had no pre-funded wallets in the early years but in the end it did not work. Many traders, who posted orders and were matched, were not able or had no intention to pay for the trade. So it became a serious trust issue to the whole marketplace and the pre-funded wallets would have been introduced with or without a Singapore license. Credit cards may be a solution but one also has to be aware that credit cards will add a significant portion to the fees.

Funderbeam’s long-term goals

The longer term goal from Funderbeam is to have an active and strong investor-base in multiple markets.

We understand the concern that Nasdaq First North in Estonia is growing too and we welcome strong competition in the early stage market. Competition is good. Currently, Estonia is our most active market, but we are aiming to widen our regional make-up and create a far more diversified market portfolio. Plus we operate on a different model. Thus our comparison has to be with the global private market secondaries providers and their novel business models instead.

We will nevertheless keep an eye on the market, developments on the revenue models and market activities. And we are welcoming your comments as very many new features, amendments and changes have been made thanks to the active Funderbeam community!

I welcome your comments!