Syndication on Funderbeam

Angel networks, accelerators, and VCs find and fund future unicorns and help them grow along the way.

However, the start-up investment process can involve a lot of time-consuming legal and communication processes, let alone follow-up funding rounds and corporate events.

What is a start-up syndicate?

To keep a simple setup, investors often choose to syndicate a deal, whereby several investors pool capital for a specific investment.

This is useful for startups as they get the benefit of a varied and potentially diverse investor pool, but only deal with one ‘entity’ e.g. Unicorn Chaser Syndicate.

While this approach is neat for the startup’s cap table, it can also come with administrative burdens such as annual maintenance which often fall on the lead investor’s shoulders.

Using a Special Purpose Vehicle for syndication

This is often the case when using a Special Purpose Vehicle (SPV), which the investors are using to invest in a company, but there are responsibilities which need to be taken into account.

A Special Purpose Vehicle is a distinct company created for one purpose, in the case of start-up investing, the purpose is to pool money to buy shares in a company.

Having interviewed lead investors all over Europe, we found that most of them had limited investment capacity due to the time consuming (and non-value adding) tasks such as:

- Setting up the SPV with a bank account that is very rarely used.

- Annual maintenance of the SPV (bookkeeping and annual reporting).

- Becoming the bottleneck of information between the startup and the syndicate investors.

On top of that, the costs for involving lawyers and accountants for setting up and running the syndicate for 10 years would often end up at €10.000-15.000.

Using the Nominee structure for Syndication

A nominee structure allows a neutral third party, like Funderbeam, to hold securities on behalf of investors.

The nominee legally owns the shares on behalf of the investors, also known as the beneficiaries. This structure allows companies such as Funderbeam to hold, buy and sell assets on behalf of investors, i.e. when investing in a company via a syndicate.

We have an article on the differences between a SPV and the Nominee structure here, which can add a little more colour to the topic.

Benefits of syndication with Funderbeam

On Funderbeam you will find a legal framework that allows a streamlined fundraising process as well as technological tools to help you with corporate governance and investor communications issues (i.e. voting) in one place. Forget about annual maintenance and daunting tasks, Funderbeam will take care of it year after year.

Funderbeam Syndication benefits in brief

✓ The Funderbeam nominee or SPV structure eliminates the need to establish and administer an SPV yourself.

✓ Manage syndicate access by invitation or investor pools.

✓ Investment agreements are signed and stored on one platform.

✓ Investor onboarding and cross-border transactions.

✓ Industry-standard KYC and Due Diligence are handled by Funderbeam.

✓ Investors retain rights to the underlying equity.

✓Information sharing and visibility all in one central online location.

✓Investors can trade shares within a Private Trading Pool, available via Funderbeam’s regulated exchange = Liquidity for Investors and Companies.

Secondaries – Funderbeam’s Unique Selling Point

What really sets Funderbeam apart from other syndication solutions is that we have secondaries as the core of our business.

We can handle OTC transactions easily with just a few clicks, or we can set up private secondary markets for investor networks, where investors within specific BANs, VCs or Accelerators can buy and sell investments like they would on any stock exchange.

The difference is that they are trading between themselves in a closed environment, where all their syndicates can be made available for further investment or liquidity events.

Our unique ability to provide 24/7 365 trading, offers liquidity to founders and investors, as well as access to further investment by invitation.

In addition to building Private Marketplaces, Funderbeam has a public exchange, in which currently there are over 60 companies listed.

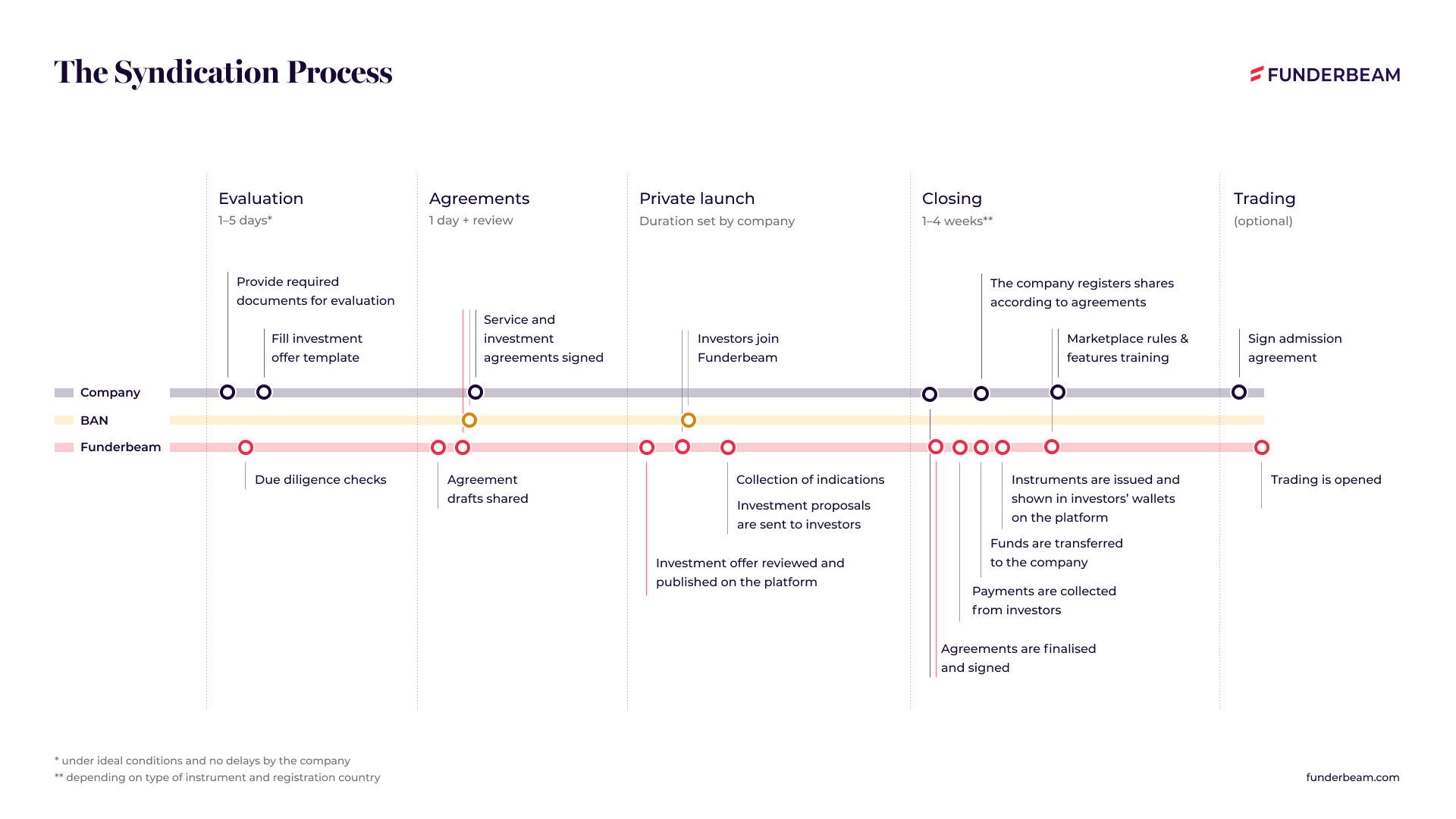

Funderbeam’ Syndication Process

The syndication process in more detail:

Are you curious to see how it works? Then book a short demo with one of Funderbeam’s funding managers or contact us on markets@funderbeam.com

Scandinavia:

Baltics:

UK:

Rest of the world: