What is the Market Discovery Period and how it works?

What is the Market Discovery Period?

The “Market Discovery Period” is a 24 hour window of more flexible trading boundaries where we seek to allow the verified investors to find the market price based on the current company position or latest news. As an international company, offering a full 24 hours gives our global community the opportunity to react and engage.

Why have this?

Growth companies can make announcements or updates that may alter the valuation more suddenly than publicly tradable equivalents. As a result, we want to offer a more flexible price corridor to investors for a short period of time, to allow traders the opportunity to review recent information, company announcements or company standing and find a new market price based on this.

Can I set any price?

Every market allows market participants to determine in the name of “free price discovery mechanism” but they all work within limits/boundaries to prevent abuse of the mechanism. As a result, there will still be limits to the range of the orders being placed.

Will this apply every time?

No, the Price Discovery Period will be offered only when, but not limited to:

- The security being listed for trading and there are no historical trades to support the reference to a Moving Volume Weight Average Price (MVWAP),

- Material corporate announcements which may result in the investors having a substantially changed view of the company, compared to before the announcement, and for which market valuation of the security may change significantly.

If there has not been changes that are considered to be materially significant then the trading will simply (re)open at the MVWAP.

Will I get notified about the corridor changing?

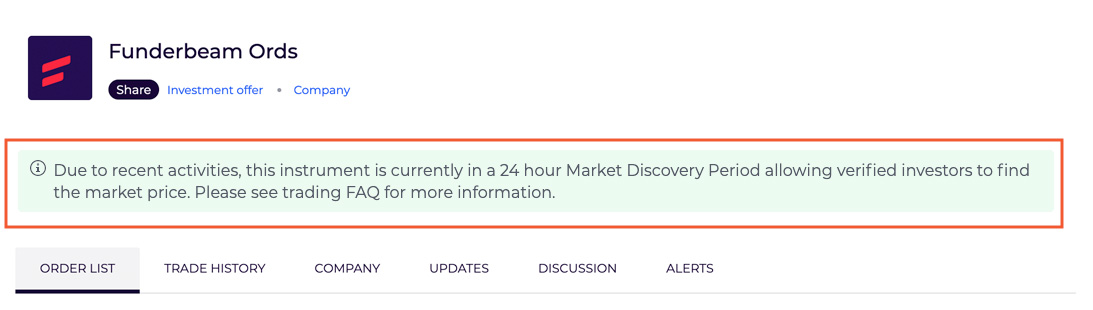

There will be a notice on the company trading page, informing that the security is currently trading in the Market Discovery Period. You will also see this while placing new orders on securities which are in this period (picture below).

What happens if there are no trades during that time?

The goal of the period is to firstly offer the market the opportunity to find the market price, however in the unlikely event that there are no completed trades during this period, there are additional reference prices that can be relied on. Such references are previous MVWAP or the initial security price.

Does this method allow prices to be easily manipulated?

No, this method is an industry standard. As each transaction is monitored for any suspicious activity, any perceived attempts to influence the price may be investigated. Normal market conditions show that prices are naturally directed to a market equilibrium, and any attempts to force/influence the market to stay at or move to unrealistic price levels would fall within the scope of market manipulation.

What happens with my orders that are now outside of the corridor?

Should your order ever fall outside of the corridor, the order may remain until the expiry is reached, then it is removed automatically. You can also cancel the order at any time until it has expired or is matched. Should the corridor shift to include your order, it may then again qualify for a match with other opposite orders within price proximity.