The Funderbeam Blog

Articles, interviews, case studies announcements and more.

Welcome to The Funderbeam Blog.

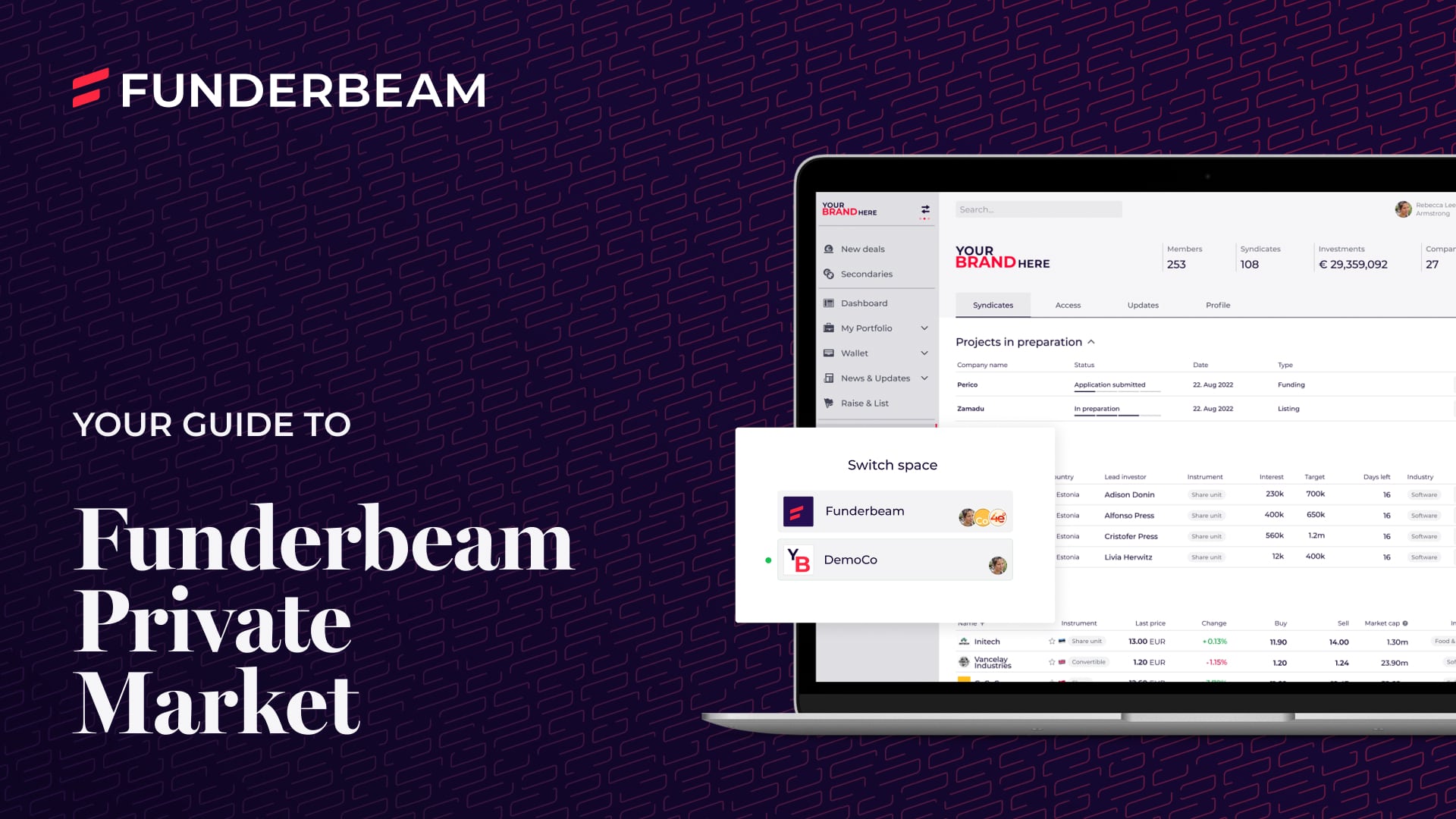

Funderbeam Private Market: A Guide

Your Guide to Funderbeam Private Market A guide to Funderbeam’s Private Market product for Investor Networks. An Introduction

In the Hot Seat 2023 – Eetu Raudas, CEO and Co-Founder of StyleDoubler

How did the year 2022 turn out for your company?In 2022, StyleDoubler achieved exceptional growth with a 4.8X increase in revenue,

In the Hot Seat – Kari Maripuu, CEO of Brightspark (Lexi Market)

How did the year 2022 turn out for your company?The year started with some great expectations, but everything turned out quite differently

Funderbeam Impact Awards 2022

Delighted to launch our new Funderbeam Impact! Our Funderbeam Impact assessment shows the real impact of the growth companies trading

In the Hot Seat – Koykan

Tell us in a few sentences about your company and the product? Koykan is a fast-casual restaurant chain that serves fresh, high-quality,

Syndication on Funderbeam

Angel networks, accelerators, and VCs find and fund future unicorns and help them grow along the way. However, the start-up

In the Hot Seat – Actual Reports

We asked Tanel Tähepõld, CEO of Actual Reports, to take the Funderbeam Hot Seat to answer common questions asked by investors

Estonian start-ups reached the 1 billion benchmark

What do mobility super-app, AI-powered identification verification solutions or self-driving delivery robots have in common?

Nine thoughts from investors: what to expect from investment trends in VC

Thank you, Wholesale Investor, for inviting our CEO of Funderbeam Exchange Jacqueline Yee to moderate Venture & Capital 2022

Investor Spotlight – Taavi Pertman

In the Investor Spotlight today is Taavi Pertman – an investor, author and financial educator at RahaFoorum.ee Why do you invest

In the Hot Seat – StyleDoubler

We asked Eetu Raudas, CEO and Co-founder of StyleDoubler, to take the Funderbeam Hot Seat to answer common questions requested by

In the Hot Seat – Make IT Easy

Make IT Easy is an automotive software company based in Zagreb, Croatia, established in 2019. Their specialized software product

In the Hot Seat: Roberta Rudokiene – Startup Lithuania

Funderbeam is actively expanding in the Lithuanian market to provide even more opportunities for growth companies and investors.

Funderbeam at Investeerimisfestival

We are very delighted to have kicked off July with Investeerimisfestival and share with you some takeaways from the Funderbeam panel

In the Hot Seat – Zenoo

Pet health and wellness company Zenoo provides natural, raw, and freeze-dried dog food subscription service in Europe. We put the

Angels syndicates – smarter and stronger together

We were delighted to co-organize Estonian Business Angels Network’s (EstBAN) annual “closing the season event”.

Founder Spotlight – Marti Soosaar

Stebby was one of the first companies on Funderbeam. We asked Marti Soosaar, the founder of Stebby, to share the journey from raising

Welcome to our Virtual pitching

We are delighted to introduce you to our first virtual pitching event. The first four companies to open our new format are Poklet,

You should ensure you carefully read the Risk Disclosure Statement before deciding to proceed with any investment or transaction, including making a purchase of securities via the Marketplace. Funderbeam has taken steps to ensure that company and securities offering information is clear, fair and not misleading in accordance with its internal verification procedures. Funderbeam does not provide investment advice or any recommendation to invest. Any investment opportunity on this website should not be considered as an offer to the public and is not directed at or offered to anyone to whom it may not be so directed or offered, or located in a jurisdiction where it is unlawful to do so.

It is important to note that funds are raised, investments are made and trade orders are placed through three investment firm service provider entities: Venturebeam Markets AS (VBAS) (authorised and regulated by the Estonian Financial Supervision Authority under permit 4.1-1/212), Venturebeam Markets Limited (VML (authorised and regulated by the UK Financial Conduct Authority under FRN 794918), and Venturebeam Markets Pte. Ltd., (VB Pte) (licensed and regulated by the Monetary Authority of Singapore under Capital Markets Services (CMS) license CMS100863). VBAS and VML are MIFID investment firms.

This page provides you with an overview of the services provided by different entities belonging to Funderbeam group. In the pages of this website, platform, and documents located on these pages (save to where referred otherwise), we generally refer to the group, which includes group of entities being direct or indirect subsidiaries of Funderbeam Ltd, including VBAS, VML, and VB Pte, as “Funderbeam”, “we”, “us” or “our”.

A Funderbeam client (whether investor or company) is a client of the service provider and under the protection of the requirements of the regulator under which that service provider operates: An EEA client’s service provider is VBAS, a UK/ non-EEA/ non-Singapore client’s service provider is VML, and a Singapore client’s service provider is VB Pte.

The applicable Funderbeam service provider has, prior to the offering of the investment offer on its Platform, verified from public registries in reasonable levels of due diligence, notwithstanding the due diligence which is also performed by the Lead Investor where applicable, which will cover at the minimum: a. that the project owner has no criminal record in respect of infringements of national rules in fields of commercial law, insolvency law, financial services law, anti-money laundering law, fraud law or professional liability obligations in all jurisdictions where practicable for such checks to be conducted; b. that the project owner is not established in a non-cooperative jurisdiction, or in a high-risk third country as set out by the Financial Action Task Force (“FATF”), and/or other government directives in jurisdictions where Venturebeam is operating.

The Marketplace is operated as an organised market by VB Pte., in Singapore as a Recognised Market Operator (RMO) under the supervision of the Monetary Authority of Singapore. VBAS and VML are Trading Members of the RMO’s Marketplace. Access to the Marketplace for EEA and non-EEA clients is only provided by and through such clients’ service provider (ie VBAS or VML). The Marketplace does not provide services directly to investors outside Singapore.

With respect to any securities or investments offered by a US domiciled Fundraising Company, by visiting this site you confirm you are not a US resident or US person (as defined in Regulation S of the U.S. Securities Act of 1933) and you understand and agree that you are not acquiring any Investments for the account or benefit of any such US resident or US person. No investment opportunity in a US domiciled Fundraising Company is directed at US persons.